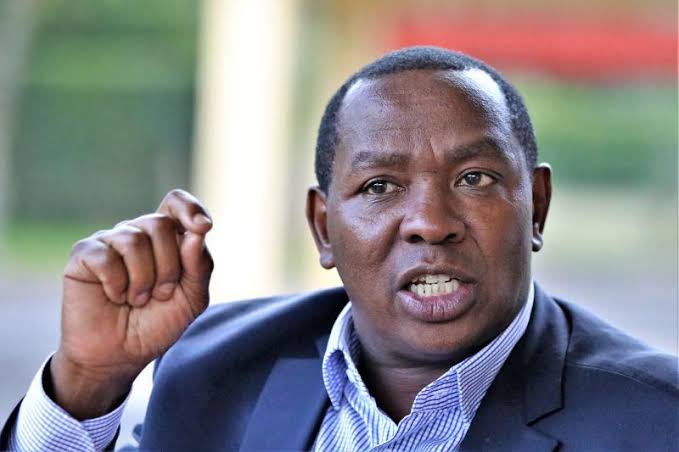

Former Laikipia Governor Nderitu Mureithi has pointed an accusatory finger at the government’s petroleum agreement with Gulf nations, painting it as the driving force behind the recent surge in fuel prices that has left Kenyans grappling with escalating costs.

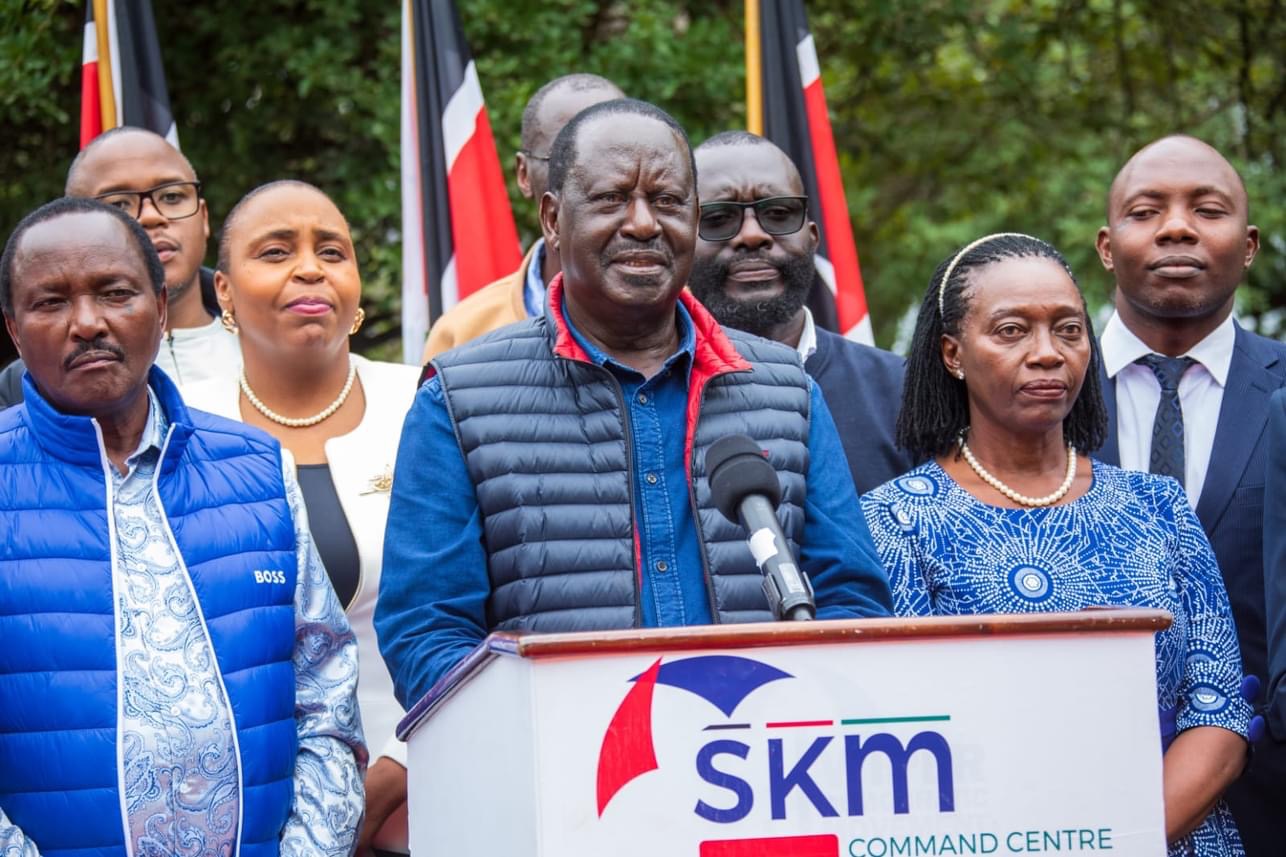

Back in March, Kenya inked a seemingly promising pact with oil giants from Saudi Arabia and the United Arab Emirates, introducing a supply of fuel on credit. This move was intended to act as a panacea for price hikes and counteract the decline in the value of the Kenyan shilling. However, Mureithi, addressing the National Dialogue Committee during Azimio’s presentation at the Bomas of Kenya, dismantled this narrative.

The former governor boldly attributed the escalating costs to the high interest rates entangled with the government’s oil deal, effectively passed on to consumers. “The government-to-government program did not address any of the cost of living issues; it, in fact, increased the burden,” he emphasized.

Mureithi went on to spotlight the impact of interest rates on Letters of Credit (LCs) and the unpredictable dance of exchange rates as contributing factors to the inflated fuel taxes. “It’s important to clarify that the increase in fuel prices is primarily due to the government-to-government arrangement, not solely because of international crude oil prices, as we’ve demonstrated to the committee,” he asserted.

The Treasury, already committing a hefty Ksh35.2 billion ($238.8 million) under the government-to-government agreement with Gulf nations, is bracing for another substantial Ksh60 billion payment due by the end of October. Noteworthy entities like Saudi Aramco, Abu Dhabi National Oil Corporation Global Trading (ADNOC), and Emirate’s National Oil Company (NOC) stand as key players in these intricate oil import agreements.

Mureithi did not stop at the critique; he took a swipe at the government’s narrative, challenging the attribution of the current inflation to international crude oil prices. Instead, he advocated for concrete measures like reducing interest rates, lowering energy and fuel taxes, and alleviating the tax burden on Small and Medium-sized Enterprises (SMEs). In a bold move, he proposed the complete repeal of the Finance Act 2022 to enforce tax reduction.

In a day filled with impassioned submissions, Azimio representatives echoed concerns about transparency in the upcoming 2022 elections. Prior to Mureithi’s revelation, the Kenya Kwanza coalition, represented by UDA Secretary General Cleophas Malala, presented their case, asserting that the 2022 elections should be considered a closed matter. The stage is set for a nuanced dialogue where economic intricacies clash with political narratives, leaving Kenyans at the edge of their seats as the nation navigates a path riddled with economic uncertainties.

Former Laikipia Governor Nderitu Mureithi has pointed an accusatory finger at the government’s petroleum agreement with Gulf nations, painting it as the driving force behind the recent surge in fuel prices that has left Kenyans grappling with escalating costs.

Back in March, Kenya inked a seemingly promising pact with oil giants from Saudi Arabia and the United Arab Emirates, introducing a supply of fuel on credit. This move was intended to act as a panacea for price hikes and counteract the decline in the value of the Kenyan shilling. However, Mureithi, addressing the National Dialogue Committee during Azimio’s presentation at the Bomas of Kenya, dismantled this narrative.

The former governor boldly attributed the escalating costs to the high interest rates entangled with the government’s oil deal, effectively passed on to consumers. “The government-to-government program did not address any of the cost of living issues; it, in fact, increased the burden,” he emphasized.

Mureithi went on to spotlight the impact of interest rates on Letters of Credit (LCs) and the unpredictable dance of exchange rates as contributing factors to the inflated fuel taxes. “It’s important to clarify that the increase in fuel prices is primarily due to the government-to-government arrangement, not solely because of international crude oil prices, as we’ve demonstrated to the committee,” he asserted.

The Treasury, already committing a hefty Ksh35.2 billion ($238.8 million) under the government-to-government agreement with Gulf nations, is bracing for another substantial Ksh60 billion payment due by the end of October. Noteworthy entities like Saudi Aramco, Abu Dhabi National Oil Corporation Global Trading (ADNOC), and Emirate’s National Oil Company (NOC) stand as key players in these intricate oil import agreements.

Mureithi did not stop at the critique; he took a swipe at the government’s narrative, challenging the attribution of the current inflation to international crude oil prices. Instead, he advocated for concrete measures like reducing interest rates, lowering energy and fuel taxes, and alleviating the tax burden on Small and Medium-sized Enterprises (SMEs). In a bold move, he proposed the complete repeal of the Finance Act 2022 to enforce tax reduction.

In a day filled with impassioned submissions, Azimio representatives echoed concerns about transparency in the upcoming 2022 elections. Prior to Mureithi’s revelation, the Kenya Kwanza coalition, represented by UDA Secretary General Cleophas Malala, presented their case, asserting that the 2022 elections should be considered a closed matter. The stage is set for a nuanced dialogue where economic intricacies clash with political narratives, leaving Kenyans at the edge of their seats as the nation navigates a path riddled with economic uncertainties.